My first Dotcom Boom startup was a spin out of the MIT Media Labs called FireFly. I was a full convert to the internet by then, believing I was engaged in a movement that would change the world. In those heady days we worked in “internet time”, competed for “eyeballs”, knew “content was king”, and were creating the “new economy” - one that would never be constrained by traditional market dynamics of our parents’ generation. We were certain the internet would make us smarter, healthier, wealthier, more connected, and more informed. Venture investments flowed with abandon, valuations achieved stratospheric levels, talent was scarce, and everywhere you looked you could find excess and wealth. Companies were going from concept to IPO in record time - e.g. Priceline launched in April 1998, and by March 1999 was publicly trading at $69 a share.

It seemed like the good times would never end.

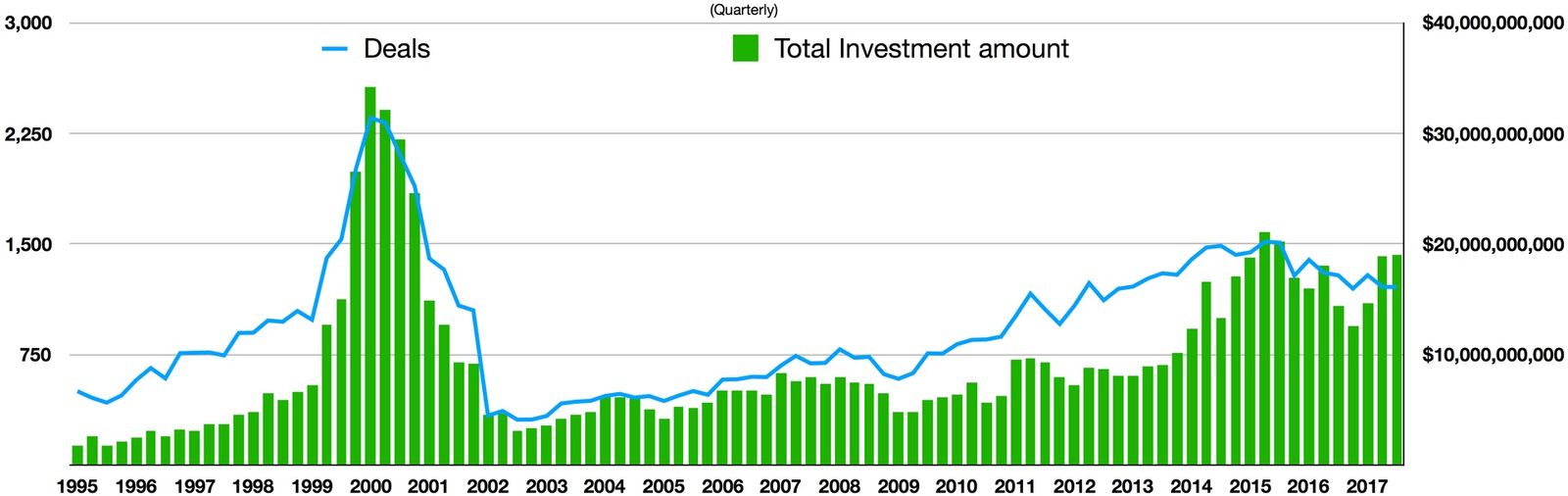

But we’ve all read the last chapter of this story. The “excessive exuberance” of the internet revolution led to an economic bubble. The Nasdaq rose over 400% in less than five years, only to give up all its gains in a rapid correction that decimated over $5T of wealth. While we remember the worst offenders - e.g. Pets.com, Webvan - there were so many less notable failures that a site called F*ckedCompany.com was launched in an attempt to keep track of the dead and dying. Layoffs followed, a tough recession set in, and suddenly it seemed like the bad times might never end. And just when we thought it couldn’t get much worse, we had a contested US presidential election followed by 9/11.

It was hard to live through that era and not come away with some life lessons. Some were simple: work with great people you trust, don't over optimize for money, work for businesses that drive real value to real customers, don’t assume the good times will go on forever, and paper wealth is not real wealth. Some were harder to learn: stay humble, stay connected to what is real & meaningful, and recognize you are never as successful / indispensible / talented as an exuberant market perceives you.

For anyone who lived through 1999, it’s hard not to look around and notice some familiar signs: a robust stock market disconnected from the real economy, excessive exuberance around technology IPOs, pervasive tech entitlement, a rapidly growing cost of labor, stratospheric startup valuations, and money flowing into more and more speculative investments (e.g. questionable SPACs, less proven crypto, NFTs).

This all leaves me wondering: are we partying like it’s 1999?