Over lunch a former colleague and I were debating whether specific Boston startups were delivering sustaining or disruptive innovation. The question seemed interesting since the difference between sustaining and disruptive innovation could be one of life or death for existing market leaders, and a strategic or fire sale for acquired startups. It was also directly applicable to me, since earlier in the summer I had decided to start looking for my “next thing”.

So the line of questions went something like this: Is Nasuni a revolutionary advance in network attached storage? Is Sonian a disruptive advance in data archiving? Is Yottaa a disruptive innovation in performance management?

Digression on the Innovator’s Dilemma

I’ll confess to being a laggard in reading The Innovator’s Dilemma. The book, first published by Harvard professor Clayton Christensen in 1997, asserts that established market leaders can do everything right and still lose their market leadership. His underlying premise is that successful companies develop value networks of customers, suppliers and shareholders that influence a company toward the sustaining changes necessary to maintain and grow their current markets. When these value networks are confronted with disruptive innovation (e.g. digital photography, discount retailers, packet-switched networks, online retailing), they cannot effectively respond since it requires competing with and/or diverting resources from their established products, markets and customers.

Clayton provides case studies of both successes and failures, including markets as diverse as disk drives, mini steel mills, hydraulic excavators, minicomputers, discount retailing and digital printing. His follow up work, The Innovator’s Solution, also adds to the research by proposing that disruptive innovation requires disruptive business strategies.

Predicting Disruptive Technologies

But for anyone looking for guidelines on predicting a disruptive startup, the Innovator’s Dilemma and the Innovator’s Solution will leave you scratching your head. We all likely agree that certain product or services - e.g. Facebook, Android, Amazon Elastic Cloud, iPad - are disruptive. Unfortunately, it’s less likely that if we met Mark Zuckerberg in 2004 or Andy Rubin in 2005, we would have foreseen this potential.

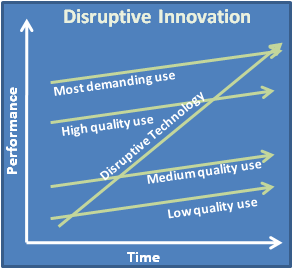

The challenge is that most disruptive startups initially deliver products that are inferior to established products in mainstream markets. Their success is based on the ability to offer “good enough” solutions to vertical markets under served by existing leaders (often in markets with few or no alternatives). Then through a rapid maturation of the underlying technology and a well executed business strategy, these startups evolve to become disruptive within mainstream markets. Android, as an example, was inferior to the existing early smart phones; Facebook was inferior to existing forms of social communication; the Amazon EC2 was inferior to existing on-premise physical and virtual infrastuctures.

Proposed Guidelines

So our lunch time conversation produced the following proposed guidelines in identifying potentially disruptive startups. Potentially disruptive startups:

- Provide a fundamental change in at least one key characteristic of a product or service that appeals to a market segment with few or no alternatives.

- The fundamental change cannot (or is not likely to) be added as a feature to existing products in mainstream markets.

- The product or service has the potential to rapidly mature and surpass existing technologies delivered by current market leaders.

- The product or service is positioned to take advantage of a fundamental market shift that results in a change to customer/consumer behavior.

- The company has a disruptive business strategy that enable it to aggressively exploit its unique technical advantage.

- The company has a CEOs and a board with proven track records in building successful large companies.

In short, disruptive startups have to have the right idea (#1-3), in the right market (#4), with the right business strategy (#5), and with the right team (#6). But meeting this criteria only buys you a ticket to the game: now, in VC-speak, you must execute. ;)

Conclusions

Predicting a disruptive startup is as deterministic as predicting the stock market. But like the stock market, there are definitely rules that can be applied to identify companies that have greater potential than others to have an outsized impact on their markets. If the past is a predictor of the future, we likely have a few Facebooks emerging in our Boston back yard. Now we just need to apply some analytic rigor, combined with a little good luck, to find them.

Related Posts: The $18 Billion Disruption, Cloud Computing’s iPhone Moment